HEALTH INSURANCE

HEALTH INSURENCE

Secure Your Health, Secure Your Family Future

Why Choose Us?

Wide Network

of Hospitals

With access to an extensive 10000+ network of hospitals and healthcare providers, you can receive quality care without worrying about hefty medical bills.

Cashless

Treatment

Enjoy the convenience of 30 mins cashless hospitalization processing at network hospitals, where your medical expenses are settled directly by the insurance provider.

Customizable

Plans

We offer a range of health insurance plans tailored to meet your specific needs. Whether you’re an individual, part of a family, or seeking corporate insurance, we have the perfect plan for you.

Safeguard+

All non-payables items are covered in our Plans.

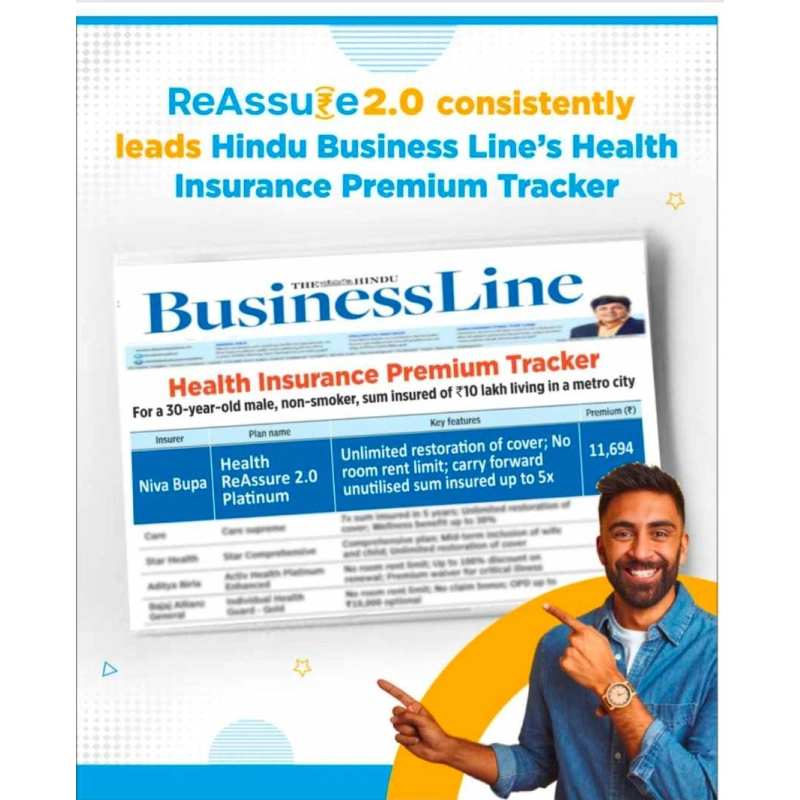

ReAssure+

1st claim triggers ReAssure+, forever. It is Unlimited. Each claim will be up to the Base Sum Insured.

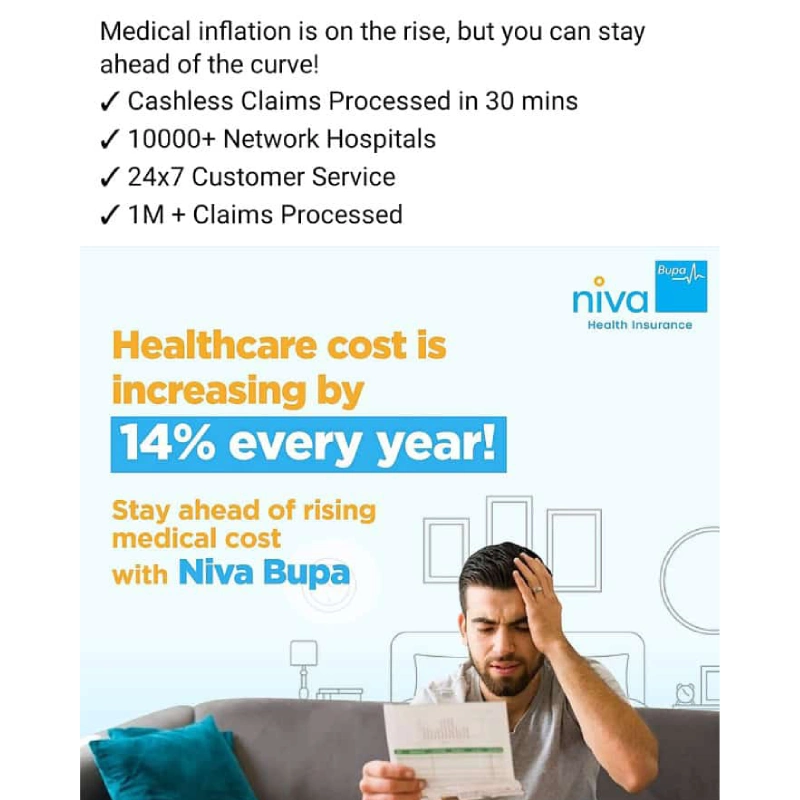

Pre- and Post-Hospitalization Coverage

Our plans cover not just hospitalization expenses but also 60 days of pre and 180 days of post-hospitalization costs, ensuring you are fully protected. No-C

No-Claim Bonus

We reward you for staying healthy. With our No-Claim Bonus feature, enjoy increased coverage for every claim-free year.

Tax Benefits

Save on taxes while securing your health. Premiums paid towards health insurance qualify for tax deductions under Section 80D of the Income Tax Act.

Key Features

Emergency Ambulance Cover

In case of an emergency, get coverage for the cost of an ambulance service up to sum insured.

Hospitalization

Covered for 2 hours and more.

AYUSH Treatment

Covered up to sum insured in network hospitals.

Booster+

Don’t lose what you don’t use. Carry forward the balance sum insured.

Daycare Procedures

In case of an emergency, get coverage for the cost of an ambulance service up to sum insured.

Annual Health Check-Ups

Starting from day 1, Stay on top of your health with regular health check-ups.

Live Healthy

Up to 30% discount on renewal premium basis step count.

Maternity and Newborn Cover

Comprehensive coverage for maternity expenses and newborn care.

Family-Centric Plans

Whether you need coverage for yourself, your spouse, son, daughter, or even your parents, we have plans that cater to every family member.

How to Choose the Right Plan?

Coverage Needs

Assess your healthcare needs, considering factors like age, family health history, and lifestyle.

Sum Insured

Choose a sum insured that adequately covers potential medical expenses in your location.

Network Hospitals

Ensure your preferred hospitals and healthcare providers are included in the network.

Additional Benefits

Look for additional features like non-payable consumables coverage, critical illness cover, personal accident cover, hospital cash and wellness benefits.